Intro

Rohit has 18+ years of corporate experience working with hybrid cloud companies and B2B SaaS companies.

Career

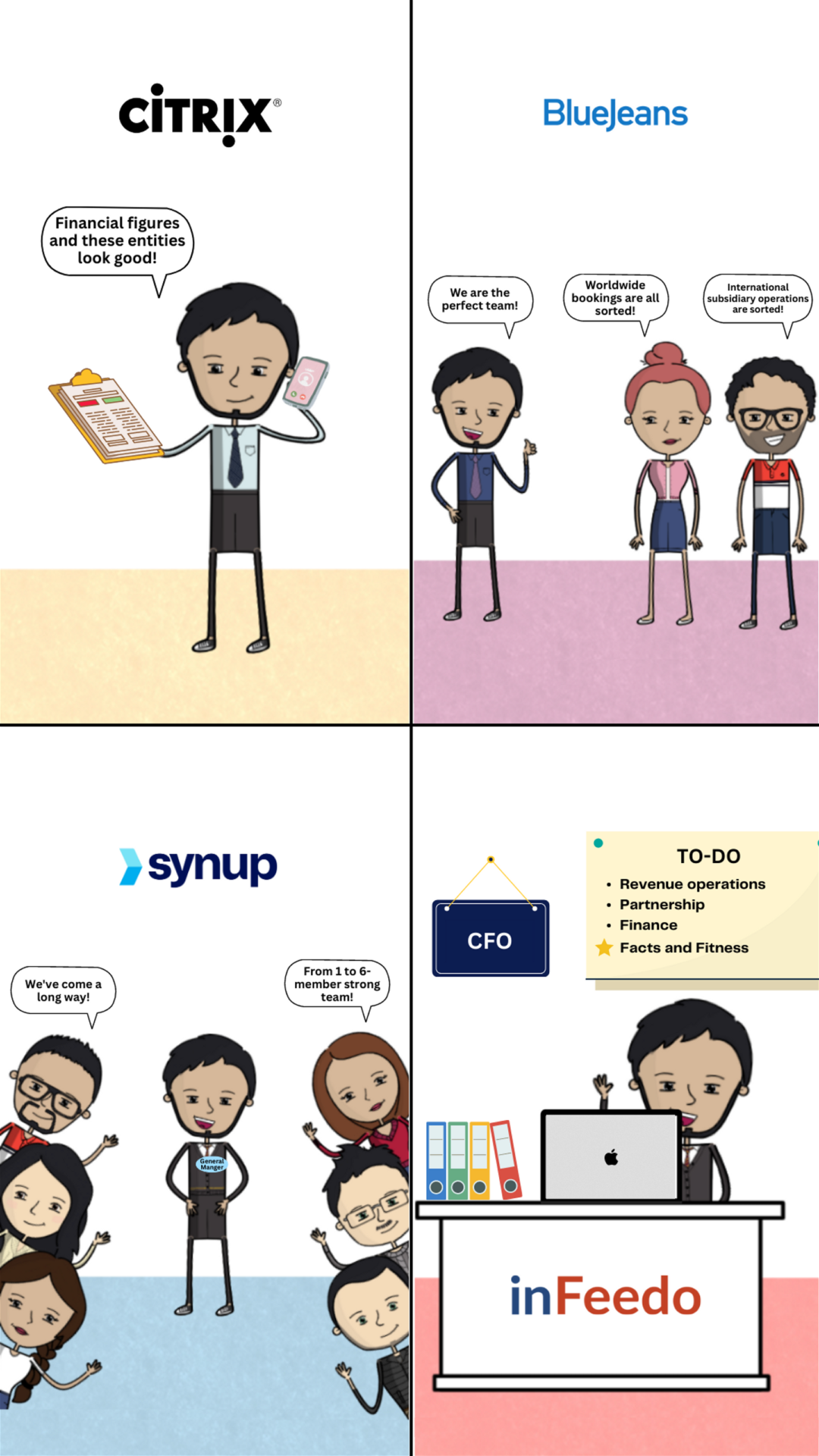

From 2008 to 2013, Rohit worked at Citrix, a company that made cloud-based acquisitions to transition from a purely hardware and software player to a cloud player. This was Rohit’s first experience with the SaaS world, where he led the finance function for all Citrix legal entities based out of India.

He joined Kronos (now UKG) in 2013. Kronos is an HR tech company primarily focused on workforce management. The company was transitioning from a hardware and software solution to a cloud-based solution when Rohit started leading the finance function of the India Sales and Services arm.

Around 2015, Rohit joined Blue Jeans, a pure B2B SaaS company, which was recently acquired by Verizon in 2020. Here, he spent close to 4 years learning about the SaaS economy. His team was responsible for worldwide bookings, reporting, billing, and overseeing international subsidiary operations.

In 2018, he joined Synup, a B2B SaaS marketing tech company focused on location-based intelligence services, as VP of Finance. He scaled the finance operations from 1 to a strong 6-member team by early 2020 and worked with the Founder & CEO and investors to grow the business to $5m+ in ARR. He also acted as General Manager for the APAC business.

Currently, he is working at inFeedo, an HR tech company focused on employee experience and engagement, as CFO. He is responsible for investor relations, revenue operations, and finance. The company has grown 5x in the last two years.

The key difference between working at startups and MNCs

1. There is a boundary defined while working for MNCs, and most people don’t like it if you cross it. Boundaries, according to Rohit, are mental roadblocks that prevent growth.

But in startups, there aren’t any boundaries. If you have a marketing background and attempt to solve a financial problem or vice-versa, no one will even question you.

2. The second important distinction between MNCs and startups is in terms of speed and agility in their decision-making. Rohit believes that startups have the advantage of faster innovation and decision-making.

What do VCs look for in a startup?

Getting traction early in the startup process depends on the problem statement, solution, TAM, Founders, and team.

They look at how well the founder can express the problem, solution, narrative, and vision. If that goes well, they are most likely to be interested.

At an early stage, it is more of conviction around the problem, PMF, and the Founder. In the subsequent stages, the unit economics, GTM strategy, Product Expansion, and Path to Profitability take more focus

The key takeaway for anyone who is stepping into a startup world is to change the mindset & be prepared to think and work beyond boundaries.

Importance of Finance Professional.

The Founders at an early stage look at the Finance function as transactional and operational, but Rohit’s recommendation is to hire a Strategic Finance leader during the early stage as it helps the Founders run their business & operations efficiently. He referred to CFO as Co-Founder of One.

Mutual Knowledge.

You’ll find that people are eager to share their wisdom and experiences with you if you share yours with them. The best and most efficient way to grow your knowledge is to share the knowledge you possess and be open to accepting the knowledge you get from others.

Financial reporting in Startup.

The majority of the Founders don’t understand the prescribed P&L format and the accrual method of accounting. The # 1 metric to track has been always ARR, Net Burn, Runway, etc. It is important for Finance to think about creating MIS which takes care of this requirement.

When it’s the best time to form a finance team?

As per Rohit, people should build the finance team as early as possible. Investors want startups to have a finance team as they want somebody to take care of accounting and compliance.

From a founder’s perspective, you need a partner to help you with Strategic Finance. Transactional and operational finance can be easily outsourced.

Strategic finance with help you identify the areas of strength where the investments should be made and the areas of weakness where the investments should be cut.