Shwetha – Much more than a Finance Rockstar!

⏱️

Fun fact: Shwetha is based in the US and she took the call with us when it was 7.00 AM in US! Great gesture ♥

Intro

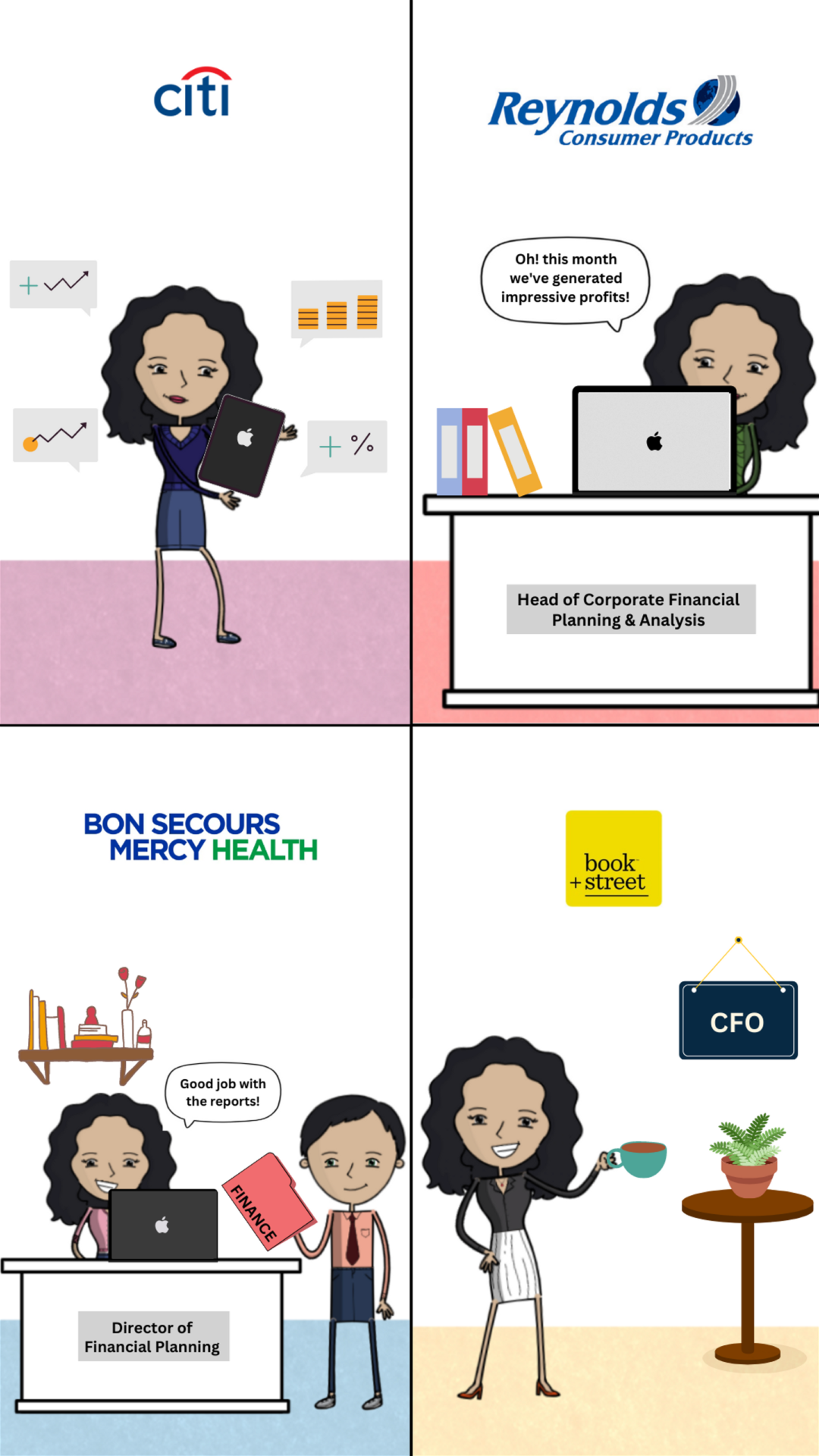

Shwetha is a seasoned executive who has worked in leadership roles in Strategy, Finance and Operations across Fortune 500 companies and startups. At present, she works as the Chief Financial Officer at Book+Street in Ohio, United States.

Book+Street provides comprehensive finance and administration services that make it easy for startups to start almost effortlessly!

Career

Her journey of 20 years has been one awesome experience-rich ride!

- Shwetha started her career as a Finance Controller at Citi where she worked for 2 years

- She then worked at JP Morgan Chase for another 2 years where she led various strategic initiatives for the Investment Banking Operational Risk team

- She then managed Strategic Mergers, Acquisitions, and Divestitures analysis for Alcoa for 2 years

- Shwetha then took charge as the Head of Corporate Financial Planning & Analysis, Corporate Strategy, and Finance Transformation, with the development and execution of the overall finance strategy across all business segments at Reynold Consumer Products.

- She then moved to Barclays Investment Bank as VP of Investment Banking Operations Strategy

- She was then the in-charge of all finance activities for the $1B multi-site global IT, Corporate Communications, and Government Affairs at Eli Lilly and Company

- She had short stints as an independent consultant, also then co-founded OrgAnalytix

- Shwetha worked for another year at Bon Secours Mercy Health as its Director of Financial Planning and Analysis

- She finally landed at Worklytics as its VP, Head Of Finance, Operations, and Marketing.

Disclaimer: This interview was taken when Shwetha was working at Worklytics, she is now working at Book+Street

About Worklytics

Worklytics is a Y-combinator-backed data analytics startup. It helps People Analytics teams quickly access reliable, meaningful, and anonymous workplace data and metrics

How finance is managed

Worklytics is still small, and Shwetha manages Finance, Operations and Marketing. She’s the only finance person, supported by external vendor consultants. Her 20 year experience helps and ensures that the FP&A is handled well, whereas the basic execution things are outsourced.

When should a startup have a finance team?

This depends on the founders’ perspective as well as the funding stage of the company. Regardless, in the early stages, even if a person is hired for managing finance, his or her role will spread across various other things such as operations, payroll management etc, inevitably making him or her a “shared resource”.

How different is it working in a startup as compared to well-established MNCs?

- Working in a startup is much more challenging & stressful than in a well-established company, mainly because one has to wear multiple hats.

- Since most startups will not have systems or processes in place, you are expected to (and don’t have a choice but to) get your hands dirty. You need to work more hands-on & ensure that the work is done whether or not there are established systems.

- You LEARN a lot. For instance, Shwetha figured out the entire SaaS Metrics or how this business works after joining startups. It was impossible to learn this otherwise theoretically.

How can a consultant differentiate it from others?

- Understanding the (SaaS) business and its nuances better in itself is a huge win.

- Help the management take strategic decisions. For instance, by discovering and analysing CAC and suggesting ways to improve that.“Finance is not just about numbers, nor is just a set of logics but a work of art and when you realise that, you understand that there are a hundred ways how you can add value to the organisation”

- Proactiveness, Professionalism and Responsiveness.

- Quick turnaround time – be it closing books or sending the reports on time – Founders hate waiting for days for getting the reports!